De Beers Group today announced that it has reached a definitive deal to sell an iron ore royalty right connected to the Onslow Iron project in West Pilbara, Australia, as part of its efforts to streamline the business and divest non-core assets in support of its Origins strategy.

Taurus Funds Management will pay US$125 million for the subsidiary firm, De Beers Exploration Australia, which owns the royalty, plus up to US$25 million in deferred compensation. The sale is projected to occur in Q4 2024, subject to usual closing conditions.

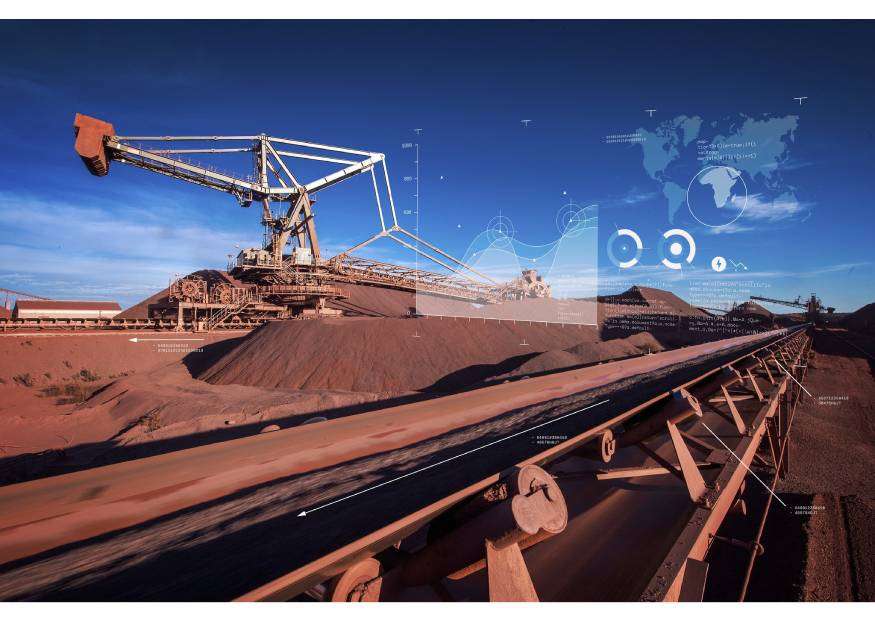

De Beers Group‘s holding of the iron ore royalty right stems from its previous global exploration activity. While De Beers‘ exploration programme yielded no economically viable diamond discoveries in Australia, it did uncover an iron ore deposit. That property was eventually sold for cash and a royalty right. With the iron ore deposit now developed, De Beers is taking advantage of the opportunity to sell its royalty rights for a profit.

De Beers CEO Al Cook stated, “As part of our Origins Strategy, we committed to streamlining the De Beers business.” We have already made great progress in lowering our overhead costs by reorganizing our personnel to match the new strategy, and the sale of this royalty right continues the process of company streamlining as we depart this non-core asset at the appropriate time and for the right price. With a simpler and more effective corporate structure, we will be able to focus on our core business of creating the world’s most beautiful natural diamonds and bringing them to market through the most value-adding channels.”