Fitch Ratings has raised Signet Jewelers Limited and Signet Group Limited’s ratings, including their Long-Term Issuer Default Ratings, to ‘BB+’ from ‘BB’. The ratings outlook is stable.

Fitch‘s confidence in Signet’s ability to keep EBITDAR leverage below 4.0x in the medium run supports the upgrade. As of April 2024, Signet’s proforma EBITDAR leverage was approximately 3.5 times. While a decrease in discretionary expenditure may slow top-line growth in the short term, Fitch believes Signet’s financial policies and debt reduction efforts will assist maintain this leverage level.

Fitch said Signet, a top specialty jeweller in the United States with roughly 9% market share, has demonstrated solid revenue and margin management, sustaining long-term revenue and EBITDA growth in the low single digits. Signet’s minimal leverage and solid free cash flow (FCF) position are important rating factors. Following the April 2024 repurchase of preferred equity, the business had around $475 million in debt outstanding and aims to keep public leverage at or below 2.5x, which is equivalent to Fitch‘s 4.0x EBITDAR leverage.

Signet’s liquidity is strong, with $1.38 billion in cash as of February 2024 and an estimated positive FCF of $320 million to $380 million in 2024 and 2025. This ample liquidity enables future debt payments, stock repurchases, dividends, and acquisitions. Diamonds Direct and Blue Nile are two recent acquisitions by Signet, both of which were funded with cash on hand.

Revenue is expected to stabilize at $6.9 billion in 2025, following a predicted dip to $6.8 billion in 2024 due to lower consumer spending and the loss of a 53rd week. Despite these obstacles, Signet’s EBITDA margins are forecast to remain in the mid-11% level, resulting in EBITDA of roughly $780 million in 2024, thanks to significant cost savings and operational efficiency.

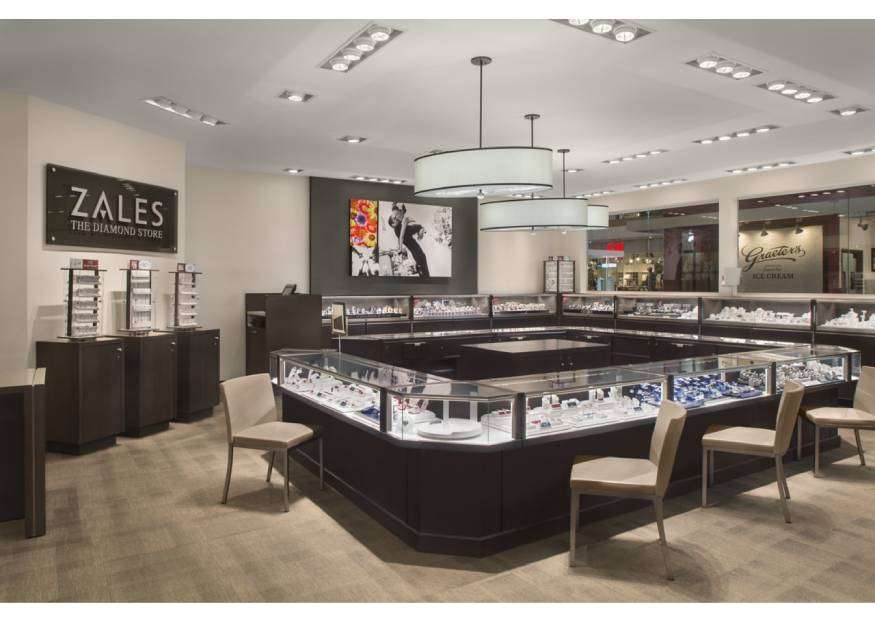

Signet operated 2,698 stores as of February 2024, under names such as Kay, Jared, Zales, and Banter by Piercing Pagoda in the United States, Peoples in Canada, and H. Samuel and Ernest Jones in the United Kingdom.The company continues to profit from its size and investments in its omnichannel platform, which strengthens its competitive position.